This is one of the most frequent questions we hear at ElderFIT: “Will insurance cover senior fitness training for my parent?”

The short answer is almost never. But the longer answer is worth exploring, because the stakes are high when it comes to your parent’s health and independence.

Why Senior Fitness Training Matters More Than Ever

Research consistently shows that regular exercise helps older adults reduce their risk of falls, manage chronic diseases, and maintain independence. According to the CDC, nearly 1 in 4 adults over 65 falls each year, and falls are the leading cause of injury-related deaths among seniors. Strength, balance, and mobility training can significantly lower that risk.

The challenge is that while the medical system acknowledges the importance of senior fitness training, insurance programs like Medicare and most private health insurance plans rarely cover it. Unless it is strictly prescribed as rehabilitation.

When Insurance Covers Fitness (and When It Doesn’t)

Here’s how it usually breaks down:

- Medicare Part A & Part B (Original Medicare): These programs cover medically necessary care, not general fitness. If a doctor prescribes physical therapy or occupational therapy to help recover from an illness, injury, or surgery, Medicare may cover those sessions. But once the prescribed therapy ends, coverage stops—even if your parent still needs guided exercise to stay strong.

- Medicare Advantage (Part C): Some Advantage plans include fitness perks such as SilverSneakers or free gym memberships. These can be great for active seniors who enjoy group classes. But they don’t usually cover personalized one-on-one training, especially not in-home services where a trainer adapts exercises to your parent’s mobility, health, and home environment.

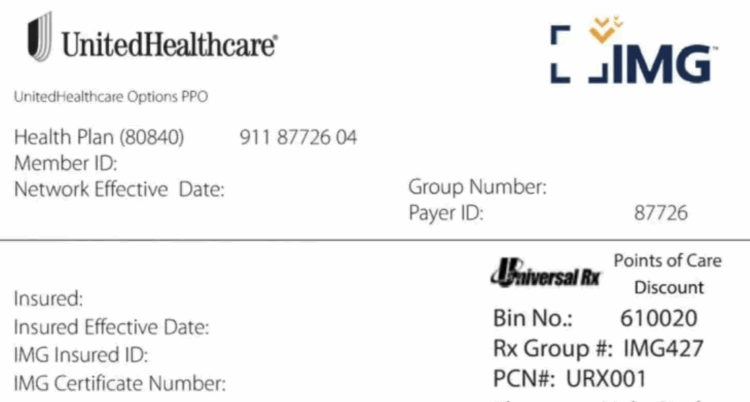

- Private Insurance: Like Medicare, most private health insurance does not cover personal training. In rare cases, if a doctor prescribes exercise as treatment for conditions like obesity, diabetes, or heart disease, some costs may be reimbursed under medical codes. These are typically billed as therapy services, not fitness training.

- HSA/FSA Accounts: Some families are able to use pre-tax dollars from Health Savings Accounts (HSA) or Flexible Spending Accounts (FSA) to pay for personal training, but only if it is tied to a doctor’s treatment plan.

Reasons to Private Pay for Senior Fitness Training

Here’s the hard truth: insurance won’t invest in prevention, but families can.

Consider this:

- The average cost of assisted living is now more than $6,000 per month (Genworth 2023 Cost of Care Survey).

- Healthcare costs for seniors are rising at 3.7 times the rate of inflation, and staffing shortages in senior living facilities often lead to inconsistent care.

By contrast, hiring a certified in-home trainer through ElderFIT costs a fraction of that. And by investing in a trainer and delaying the high cost of assisted living, families can end up saving thousands of dollars each month.

The Bottom Line

So, does insurance pay for senior fitness training? Not really. Aside from limited therapy coverage or generic gym perks, families almost always cover these costs themselves.

But by having an aging parent start working out on a regular basis, families can ensure their parents have a chance to ‘age in place’ where they feel most comfortable and happy.

We recommend you check out the ElderFIT Assisted Living Cost Calculator to figure out how much families can save annually by investing in an in-home senior fitness training program.To learn more about how to find an in-home personal trainer for your aging parent or relative, please visit ElderFIT.